Mortgages – for the greater good

Expect no real change of direction – guest blog by Robin Smith, commenting on broader issues of land policy…

- how mortgages have evolved into a neodemocratic political tool.

- that mortgages harmonise all political parties meaning it doesn’t matter who you vote for any more

- why the homeowner never funds bank bailouts and the saver or tenant always does.

- the effects of this on 2026 and the likely next great recession.

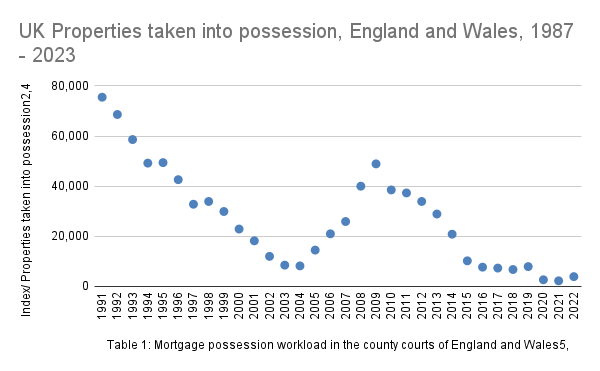

Source: UK Ministry of Justice

At a property network event a property manager told me recently how they had made it with multiple properties through the past two business cycles in 1989 and 2008. But didn’t know or had forgotten how. And how their old boss who took more risk and had way too many bonds on his books, had not made it, because he was trying to be super wealthy – ‘the bad manager’.

I suggested the property manager had survived well because he had not been greedy. He had not got over-leveraged on mortgage debt. And that government of all parties will implicitly protect both borrowers and lenders so long as they do not get too greedy. The theme of this post is simple – we hear it daily “who am I going to vote for, they are all the same where it matters”. The great mass of people intuitively knows this is true but do not yet have the language to say why.

View the chart above to see a historic record of mortgage induced repossessions over 2 complete business cycles. This data is government sourced from the UK Ministry of Justice. It is not an opinion; it clearly shows that over the time frame of more thanover two whole business cycles since 1989, mortgage repos are reducing and closing in on zero. Note the two peak inflection points which preceded the next race period toward zero. These peaks are the inevitable corrections following a widespread national homeowner exuberance on debt, followed by an uncontrollable financial panic and bank run.

Curiously similar data from the same source but for landlord repos of tenants, the numbers have been static for a shorter time frame. So tenants might not be getting bailed out and there was no sign they would be… until the pandemic years.

Source: the Ministry of Justice

And interestingly, look to the 3 pandemic years on the far right – isn’t it obvious that government bailouts reduced the repos more than normal, already, years before the great recession hits. They are preparing the way. I’m not by any means saying this was a deliberate conspiracy. But they certainly know it is possible to get to near zero now from that experiment.

We are now facing another enormous recession in 2026 if the chart repeats its relentless march, and once we hit that year, I am suggesting that this time special government measures will bail out ALL homeowners this time, not just a lucky few, so long as they do not get greedy and keep em peeled.

Government will underwrite all mortgagors and rescue them somehow, probably with QE as usual. But QE is less popular these days because the public can see it for what it is after the pandemic furlough. So are more likely to use non-cash measures which have the same bail out effect and more politically acceptable.

The chart ranges over 10 governments, 2 political doctrines and one coalition, encompassing the entire political spectrum where it matters. It is hard to argue that left, right and a fusion of the two have not been ever present and in central command of the UK economy over this time frame.

Here is the really hard observation, especially for a seasoned political animal to come to terms with and especially the proud democrat. These are for the UK 2019 general election

- Registered voters – 47 million

- Households – 28 million (2 million more than the 2008 recession)

- Voters per household 1.7 (turned out 1.2 or 32 million, citizens per household 2.4)

Each home has nearly 2 votes, with over half of them turning up to vote. All homes together as a class represent the overwhelming body of voters in the UK, regardless of party affiliation or ideology. These numbers will be the same in all nations, only varying at the margin. We can quibble about only a two thirds turnout(which at 67% was relatively high). But are 32 million people, more than half, not enough to reinforce my point already?

It is also hard for anyone to accept that all parties are united, fundamentally, on “homeownerism”. And are divided only by superficial party doctrine. That I care about your race, creed, gender and want to save the planet, or, that you care about your free speech, justice and your right to roam, is a socially induced smoke screen.

It is a masquerade. What really matters to me is that I can get on the housing ladder. And that government will bail me out during hard times. Whichever party maximises my chances here will get my vote. Each party will be unconsciously scrambling to find the marketing to deliver what is in reality an all party policy which all agree with.

The vehicle used for this hidden policy… is the mortgage. And that government of all parties has been proceeding with this harmonious policy for the past 2 business cycles is clearly evident in the chart supplied by their Ministry of Justice above. Slowly over time government of all parties underwrite my mortgage with savers’ cash and tenants’ income tax, VAT and businesses capital gains tax and national insurance contributions. Go ahead, call me anti tax. I don’t care. I am just pointing it out for what it is so it won’t help your cause to muddy the water with that strawman. Your favourite party is right behind it and fully upholds it. They have to or will lose.

Is there any sign of them changing policy? No! Not a single party intends to change. I forecast that, following the crisis in 2026, whichever ideology rules us will bail out homeowners before all others, by forcing the banks to prohibit foreclosure in one way or another. It might as well be cash payments but that won’t look good to do it so overtly. So all manner of latent bailouts will be used.

On the run up to 2026, no party will allow house prices to fall either. The party will adopt policy which causes boom times. The objection to this is that it is so unfair that prices make housing unaffordable. But no one dares mention to whom exactly housing is unaffordable and less still are willing to scrutinise it properly. There are about a million first time buyers annually right now, which sounds like a lot, does it not? If the party in power genuinely makes an effort to help them they will have to somehow get prices to fall precipitously to so called affordability. This might be done by taxing land values, confiscating housing from those deemed unworthy or similar – all to buy the votes of 1/28th of the electorate!

Making housing ‘affordable’ means doing what just 4% of the population want. Think about it – that will make whichever party does this, unelectable for the next 20 years, about the lifetime of a mortgage. I am no fan of politicians who clearly are not that smart today – but do you really think they’re that stupid. And even if they were stupid anyway, how would the overwhelming majority of homeowners respond to a policy of a successful blatant confiscation? Civil war perhaps?

In 2012 I was the first to stand for the Young People’s Party in the Croydon North by-election, on this exact platform. Our policy ( I was the only candidate to have a policy anyone could tag onto) was something called a Location Value Covenant – a radical and innovative financial instrument to start correcting things gracefully, did not require confiscation, without destroying banking and adoptable without the force of statute – it was voluntary for the property owner. A homeowner could choose to use a traditional mortgage or save a bit by getting an LVC instead. A virtuous circle could be formed that might grow if people wanted it to. And wealth and power would not be intimidated. And government not embarrassed. The most shocking aspect in the world of reform was that the land value tax movement opposed it with more ferocity than the libertarians and socialists (who were clueless anyway never taking a moment to understand the policy, being driven and blinded by ideology). That is quasi religion for you.

We recognised the average age of the first time buyer was approaching 40 years old, middle age. This is how we named our party thanks to the drive and ideas of the late and great Mark Wadsworth and Dr. Adrian Wrigley. We laughed when the press would announce me as ‘Robin Smith, Young People’s Party AGED 49!’ We did not laugh so much as on the hustings we delivered our policy to the young and poor of North Croydon who wanted to get on the ladder and to be bailed out when times got hard, just like everyone else, in spite of having the opportunity to change things at last. We learned that when push comes to shove and our future, family or household is up for grabs, we suddenly as if by magic become the same age. No! Not only the same age. But the same colour, sex, gender and identity – the one time where all if us are truly united.

As a jobbing politician I realised people vote for whichever party has the best property deal for me. The latent policy of all political parties today is to bail out homeowners, to buy their vote. This is clearly evident and intensifying as shown in governments own data in the chart as we move through each business cycle. And soon I expect in 2026 it will hit zero when all homeowners will get bailed out. And this is why the people no longer know who to vote for, all parties being fundamentally the same, to all intents and purposes – their ideology being an entertaining, high sounding, intellectual illusion to hide behind. To lie to themselves about. This is why house prices will boom over the next 2 years, and why it will be left to nature, to correct the market in 2026 because we the people, are now democratically harmonised by the mortgage – for the greater good.

Who will pay this time? The same people and classes who always pay

- Savers – regular hard working people and enterprising businesses who have put aside a surplus

- Tenants – householders who rent their homes will gain no benefit from a bailout if they do not own. Tax theft of their private property (wages and salary) will be how they cough up

- Highly leveraged mortgagors – the greater your debt to equity ratio the more you are like a tenant. In economic terms mortgage interest nominally, is a de facto economic rent.

The question I am asking myself, is does this mean policy of government of all parties is to bail out everyone, on the principles of Modern Monetary Theory?